LET THE EXPERTS TAKE CARE OF YOU!

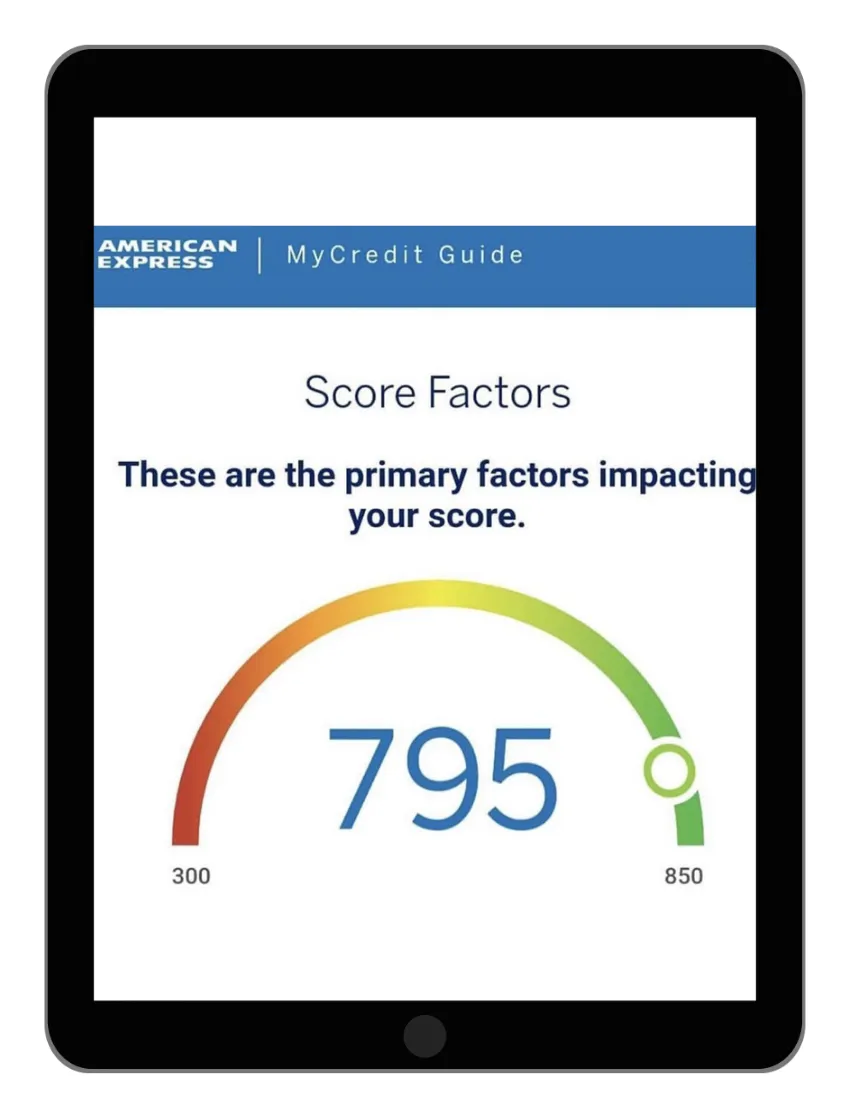

We Specialize In Helping People To

Eliminate Thousands Of Dollars

Worth Of Debt Off Your Credit Report

👉🏽👉🏽 Disclaimer: I am not an attorney. I do not give legal advice. Results may vary.

Our Services Include:

Credit Repair

Primary Tradelines

Authorized User Tradelines

We Specialize In Helping

People To Eliminate Thousands Of Dollars Worth Of Debt Off Your Credit Report

TURN SOUND ON

Disclaimer: I am not an attorney. I do not practice legal advice.

Our Services Include:

Credit Repair

Child Support Cancellation

Credit Repair Masterclass

We Use The Power of The Consumer Law to

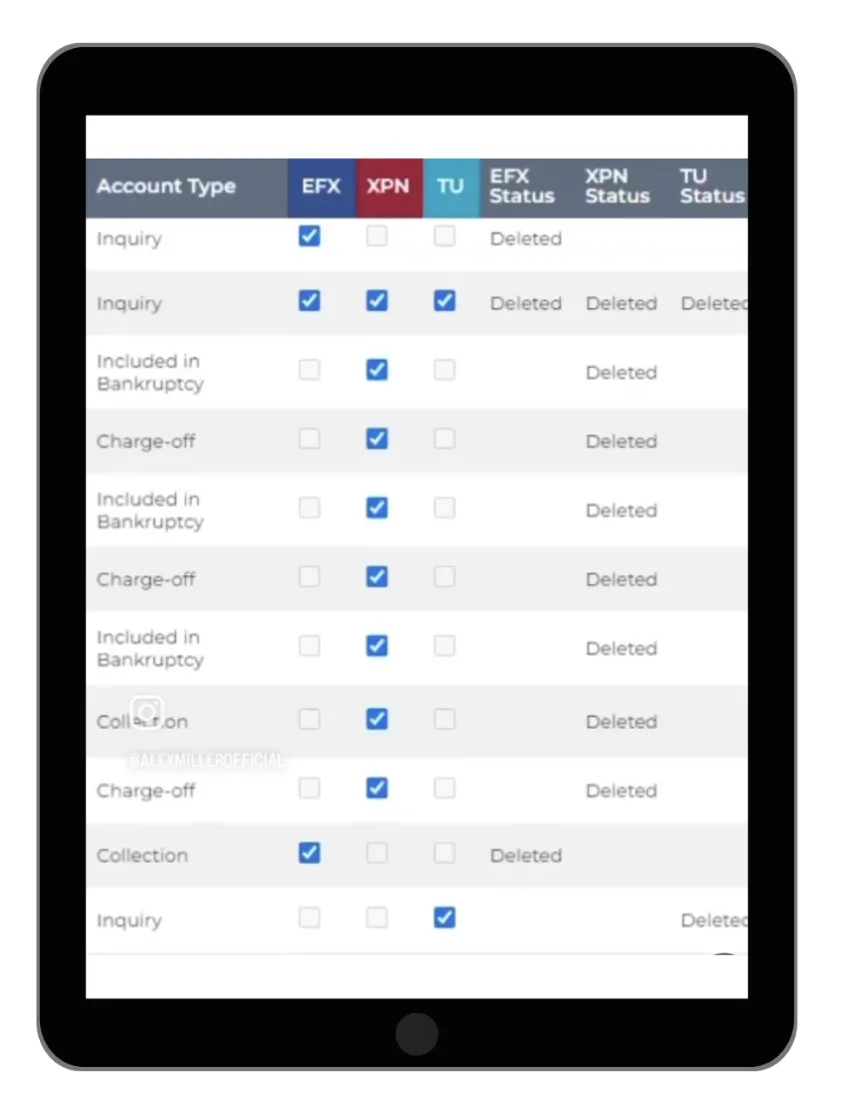

Remove Common Credit Report Errors Like:

We Use The Power of The Law to Remove Common Credit Report Errors Like:

- Late Payments

- Collections

- Hard Inquiries

- Charged-Offs

- Bankruptcies

- Student Loans

- Judgements

- Repossessions

- Foreclosures

- And Much More...

Late Payments

Collections

Hard Inquiries

Charged-Offs

Bankruptcies

Student Loans

Judgements

Repossessions

Foreclosures

And Much More...

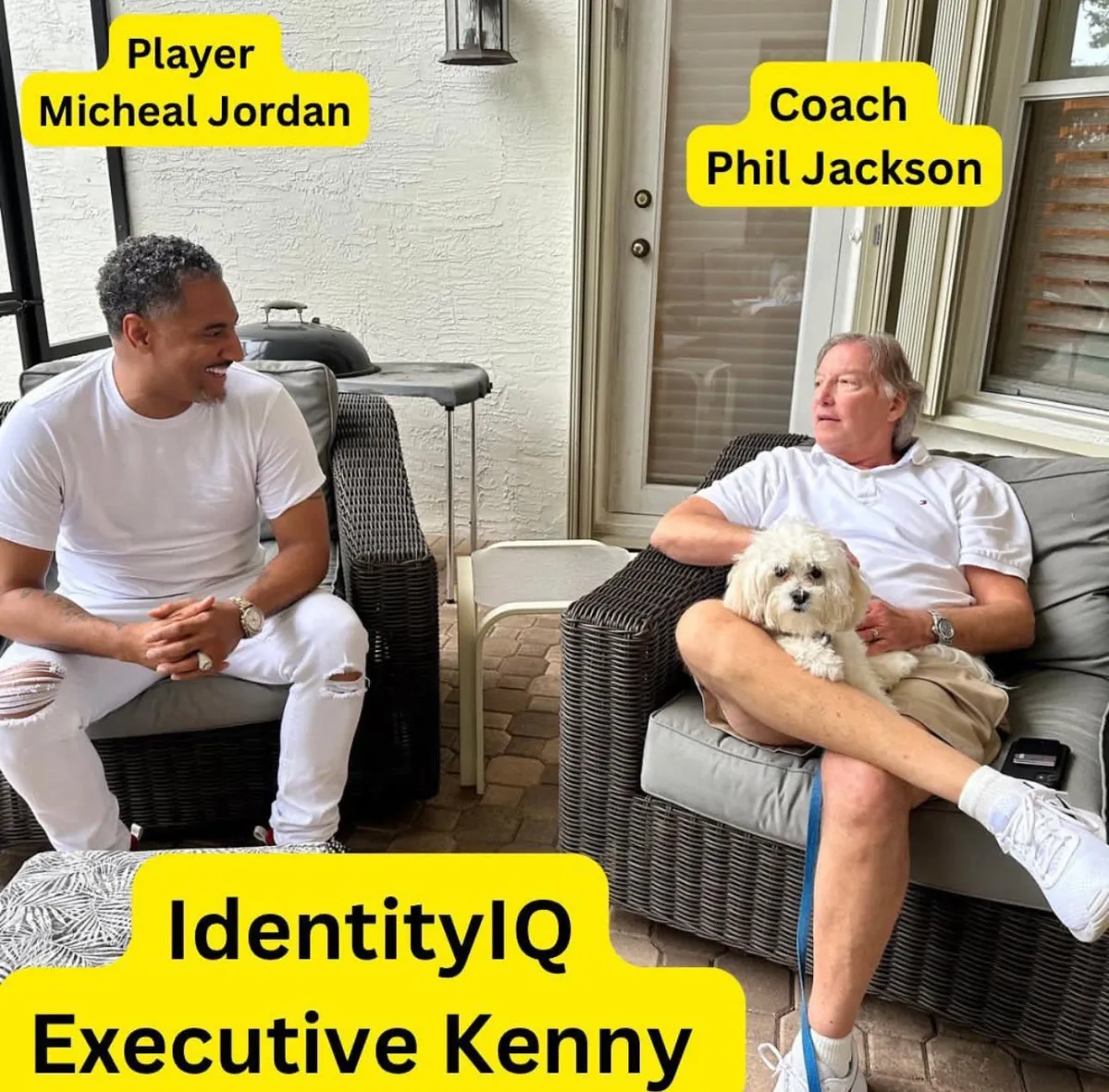

Here Is How Our Credit

Repair Process Works

- Step 1: Credit Analysis

We go over your credit report with you to find negative items that are inaccurate, help you understand the process of credit repair, and prepare a plan of action with you to improve your credit.

- Step 2: Dispute

We work with the credit bureaus and your creditors to challenge the negative report items that affect your credit score using our legal team.

- Step 3: Track Progress

Sit back and let us handle the work. You can see your client portal 24/7 for live status updates on improvements on your credit report.

- Step 4: Credit Restoration

We will do our best to maximize your results using our custom tactics on the bureaus so you can restore your credit and achieve your credit goals.

- Step 1: Credit Analysis

We go over your credit report with you to find negative items that are inaccurate, help you understand the process of credit repair, and prepare a plan of action with you to improve your credit.

Step 2: Dispute

We work with the credit bureaus and your creditors to challenge the negative report items that affect your credit score using our legal team.

- Step 3: Track Progress

Sit back and let us handle the work. You can see your client portal 24/7 for live status updates on improvements on your credit report.

Step 4: Credit Restoration

We will do our best to maximize your results using our custom tactics on the bureaus so you can restore your credit and achieve your credit goals.

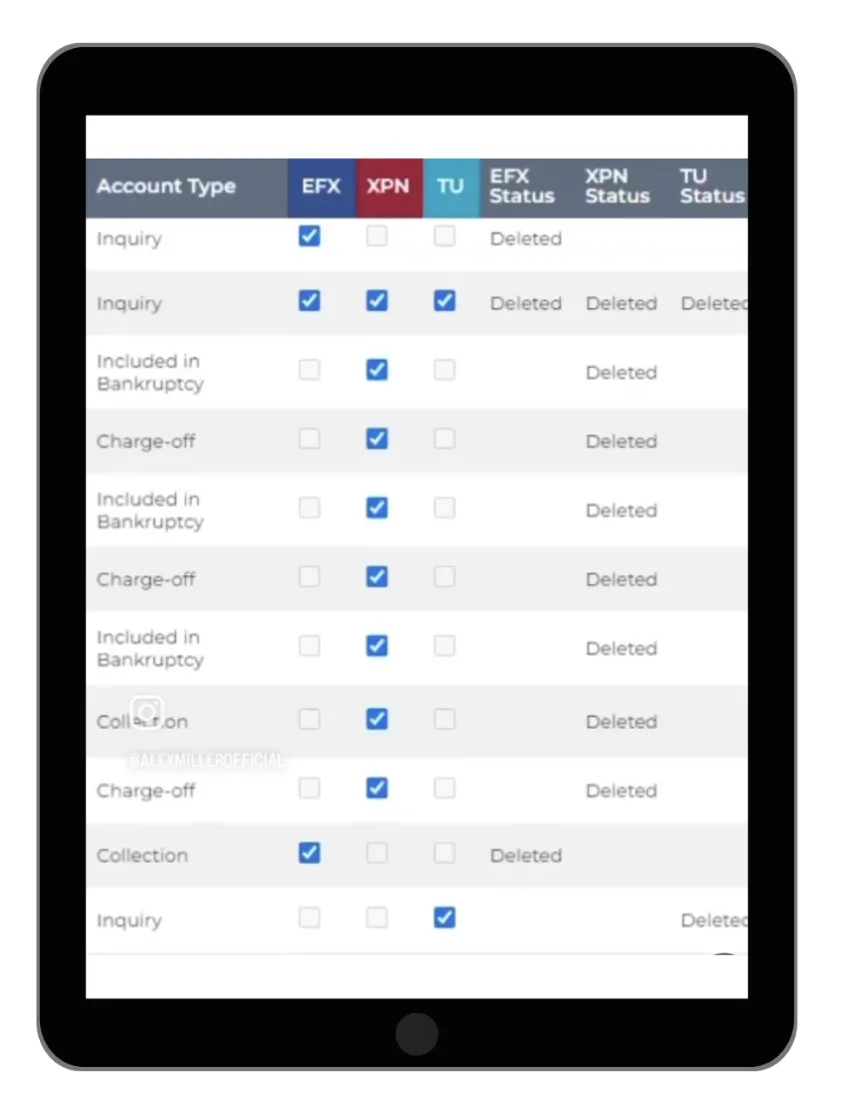

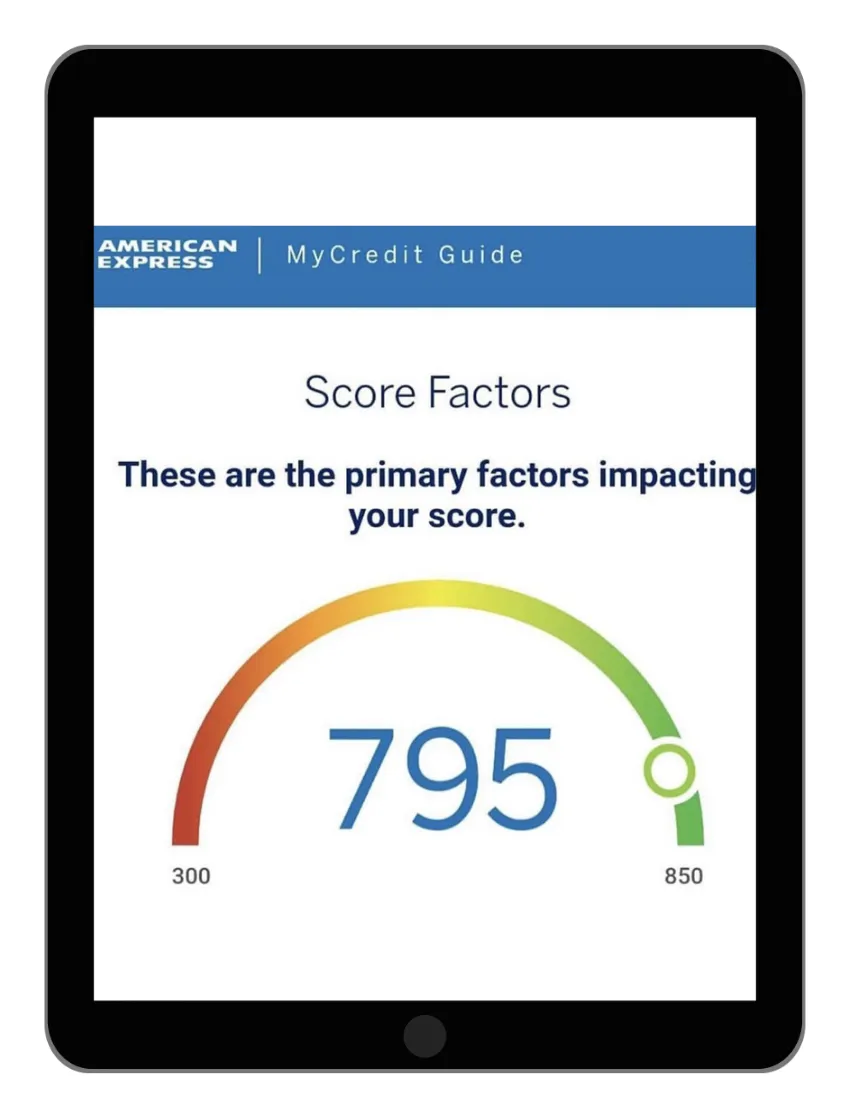

Client Testimonials

TURN SOUND ON

TURN SOUND ON

FAQ'S

Credit Repair is actually the process of removing inaccurate, unfounded, out of date, false, and erroneous information from your credit report. Your credit report dictates your credit score. The 3 major credit bureaus collect information from lenders, creditors, and debt collectors and apply it to your credit report. Based on that information, your credit score is determined. This information could include the balances on loans or credit cards, credit inquiries, debt to income ratio, and most importantly, credit utilization (the percentage of debt you have to available credit)

Can You Remove Anything From My Credit Report?

We can only fight to remove any items that fall under the guidelines of the FCRA. These are items that should be removed due to being inaccurate, unfounded, out of date, false and/or erroneous.

How Much Does It Cost?

The price varies depending on what you have on your credit report. To get a proper estimate, please book a FREE Consultation + Credit Analysis Appointment with a credit expert by clicking the Button below:

Is Credit Repair Legal?

Yes, credit repair is legal & we use the law in your favor. That law is called "The Fair Credit Reporting Act." The FCRA gives you the right to dispute any item on your credit report. If that item cannot be verified within a reasonable time (usually 30 days) it must be removed. Studies have shown that 79% of all credit reports contain errors. This is nearly 8 out of 10 reports. Therefore most credit reports improve immediately. For items that disputed that are not errors, a creditor or furnisher is often unable to find the records or signed documents within the allotted time and the item gets removed. Sometimes the furnisher will say it has been verified by not offer proof. It is our job to prepare documents that challenge this and we are very skilled at that.